“Your duty as a soldier is to fight for your religion. Do not hesitate; this is the best

you can do for your religion. For soldiers like you, this is an opportunity to reach Paradise. If you do not fight, that will be a sin. You’ll be disgraced. It is better to die (and go to Paradise) than let others speak of your infamy. Noble fighters will take you to be a coward. You’d either go to heaven if you die, or will enjoy fame and wealth if you win. So fight for the sake of fighting (to attain heaven or wealth), loss or gain, victory or defeat, killing will bring you glory, not sin.“

Those probably are the motivational words the ISI Major spoke to Kasab and company while they were preparing to attack Bombay on 26/11. Those were , almost precisely, the words that the trainer of a suicide outfit in London told his students (which included a white convert) while preparing them to bomb London. Unfortunately, they were recorded by London intelligence and caught before they could carry out the holy job. BBC ran a program on that recording. The white guy was hesitant and rather unconvinced; the trainer taught him exactly what to say when he met Allah. The trainer even knew the questionnaire that Allah would pose to him when he reached paradise and tutored him what to say.

Don’t gloat over those Al- Qaeda-style instructions. Those were in fact the words that I have quoted from Bhagavad Gita 2.31 to 2.38.

That white guy was hesitant because of fear for his life may be, or was worried about the uselessness of wanton killing. Perhaps the assurance that Allah would appreciate the deed did make a difference to his thought process. Arjuna, on the other hand, was distressed at the possibility of killing nearly all of his kith and kin – “fathers, grand-fathers, uncles, fathers-in-law, every kind of relatives’ (2.35). Krishna, unlike the Islamic terrorist of London, did not have to assure him that he would meet God and that He would be pleased. Instead Lord Krishna spent chapters after chapters to reassure him that He was God himself. Arjuna possibly wasn’t convinced enough – so the Lord braced himself up and showed His true form. (This awesome display took place in the middle of the battle field where the warring parties ware arrayed on either side. Why the opponents did not get frightened and run away beats me). Furthermore, I can’t help admiring the Kaurava’s side (Great-Grandfathers, fathers, teachers et al) for holding their horses – literally – for the three or four hours it must have taken Krishna and Arjuna for chatting away in the middle of the battle field.

The terrorist in London did not philosophise about the consequence of killing. He probably read out aloud Quranic verses , 2:191, 4:89, 8:65, 9:29, 5:33, and so on from the Holy Book. As Mahatma Gandhi and other wisemen had said, all religions lead you right down the same garden path.

Lord Krishna, being God himself, does not quote other’s verses. He philosophises

killing. Killer is not a killer, nor the one presumed killed is killed. (2.19). Killing is like helping a soul discard his old garments and put on new ones (2.22). One who is born is bound to die, and the dead one would take rebirth. So your killing( your relatives and teachers) Should cause no sorrow . They aren’t there to start with; they are there interim, and then they aren’t there any more. So why cry? Soul is an amazing and incomprehensible thing. It’s what dwells in your body – it cannot be killed. So why grieve for those whom you kill? (2.27 to 2.30).

This is the crux of Srimad Bhagbad Gita.

What is Gita?

The Bhagavad Gita, often referred to as simply the Gita, is a 700-verse Hindu scripture in Sanskrit that is part of the Hindu epic Mahabharata (chapters 25 – 42 of the 6th book of Mahabharata).

The Gita is set in a narrative framework of a dialogue between Pandava prince Arjuna and his guide and charioteer Lord Krishna. Facing the duty as a warrior to fight the Dharma Yudhha or righteous war between Pandavas and Kauravas, Arjuna is counselled by Lord Krishna to “fulfill his Kshatriya (warrior) duty as a warrior and establish Dharma. The Bhagavad Gita was exposed to the world through Sanjaya, who senses and cognises all the events of the battlefield. Sanjaya is Dhritarashtra’s advisor and also his charioteer.

There is a blind assumption that time was frozen by Krishna when he narrated 700 slokas to Arjuna.

This is based on fact that it takes atleast 2-3 hours to narrate 700 slokas and warriors on either side would not have patiently waited for Krishna and Arjuna to finish their conversation before war began on day 1 in Kurukshetra.

Many historians claim that Gita was not part of original Mahabharata and was later added during Kushan dynasty rule to decimate the atheistic influence of Buddha. (Believe it or not, Gautam Buddha who is incriminated as God by the Hindus, never believed in God himself. He always opposed the origin of God, and said “There is no heaven or hell, God or all mighty in these universe. He did not believe that Vedas are autonomous and ‘atma’ or soul to be eternal. )

We can find in present day Gita that it was written by multiple persons as few intial slokas appear in first person narrative and suddenly it jumps into third person narrtive.

Gajanan Shripat Khair, who researched for 43 years on Bhagavad Gita, concluded in his book ‘Quest for the original Gita‘ that infact it was written by 3 persons over 400 years and that is why narrative lacks continuity.

This theory is widely accepted by all the historians.

Sukumari Bhattacharya in her book ‘Why Gita?’ quotes J. L. Brockington:

” The Bhagavadgita must be considerably later, more like the first century C.E. The structure of the text seems almost more consistent with the later epic part of the text, since it contains a brief statement of Arjuna’s dilemma and not just Krishna’s answer to it. It must have been intended as a separate composition and not another layer added to the epic part.”

Also few inclusions like ‘description/creation of caste system’ , ‘women, sinners and lower castes’ being treated similarly etc were according to the society in those years.

Ethical values in Bhagavad Gita

Killing is not wrong

Bhagvad Gita says that killer is not a killer, nor the one presumed killed is killed.

ya enaḿ vetti hantāraḿ

yaś cainaḿ manyate hatam

ubhau tau na vijānīto

nāyaḿ hanti na hanyate (2:19)

(Neither he who thinks the living entity the slayer nor he who thinks it slain is in knowledge, for the self slays not nor is slain.)

In chapter 11 verse 33 we see that Krishna is alluring Arjuna to kill his family members and achieve glory and win the kingdom. He tries to get Arjuna out of his guilt by saying that Arjuna’s enemies are already been killed by Krishna and he (Arjuna) is just an instrument.

tasmåt tvam uttistha yasho labhasva

jitvå satrün bhunksva råjyam samrddham

mayaivaite nihatå˙ pürvam eva

nimitta-måtram bhava savyasåchin (11:33)

(Therefore, arise and achieve glory! Conquer your foes and enjoy a prosperous empire! all your enemies have already been killed by Me – you are but an instrument.)

Killing is like helping a soul discard his old garments and put on new ones

na jāyate mriyate vā kadācin

nāyaḿ bhūtvā bhavitā vā na bhūyaḥ

ajo nityaḥ śāśvato ‘yaḿ purāṇo

na hanyate hanyamāne śarīre (2:20)

(For the soul there is neither birth nor death at any time. He has not come into being, does not come into being, and will not come into being. He is unborn, eternal, ever-existing and primeval. He is not slain when the body is slain.)

If this be so, then a muder should no longer be considered a crime–it is only an act of liberating the soul from the clutches of the vile body. If atman is immortal and the body comes to an end sooner or later, does it justify our killing other persons ? It is true that the Kauravas would have died their natural deaths some day, but that could not be a justification for Arjuna to kill them today.

Why, then, can’t Modi-Amit Shah-Pravin Togadia enact a law that killing is perfectly legal? One might argue that Krishna was speaking of killing in war, which is a duty. If fighting between cousins for land is war, don’t the communities that fight each other see it as a war for existence? Ask Mr. Modi at Gandhinagar. Weren’t Bhinderwale’s men and Indira Gandhi ‘s Congress at war with each other? What difference does it make to the deathless souls whether they are being made to change their wardrobe in war or in a communal or personal clash?

PM Modi says that “This country believes in Gita.” What PM Modi meant is that this is a Hindu Nation; forget the Constitution. Mr. Modi obviously has not read Gita. If he did, he has not understood the Sanskrit verses. Most television-show talkers on Gita are more interested to wow the audience with their stale humour and flying-on-tangent parables. Modi might not have the time to even attend one of those discourses.

Mr. Modi, Bhagavad Gita, by no reckoning, is an epic. The “Divine Song” is a piece extracted from the incredible epic called Mahabharatam and expanded to glorify fratricide on the one hand, and Lord Krishna himself on the other. It’s a philosophy that justifies Aurangazeb imprisoning his father; Indira Gandhi’s favourite bodyguards shooting her to death. What other “epics” have you read, Mr. PM, to conclude that no other epic can compete with Bhagavad Gita? True, some white men (who are always the authority – don’t we see our babas promenading a couple of paid whites in front of them to establish their spiritual superiority?) have certified Gita to be a great scripture. But they have also praised, often more forcefully, the other scriptures.

Time and Place for Preaching

Let me assume hypothetically that Mahabharat is real history and Krishna was a god in human form.

The thing that strikes us at the outset is that the occasion and place for preaching of the Gita was highly inappropriate for such a philosophical discourse. When armies are standing in array on the battlefield with the chariot horses and elephants, we cannot believe that anyone could think of preaching deep philosophy, and that too at such length.

The Gita consists of about 700 stanzas which are difficult to understand without suitable explanation. Let us assume that the recitation and explanation of each stanza took at least one minute ( Chinmayananda took 30 minutes for this), which is by no means an estimate on the high side.) In that case, it would have taken 700 minutes or more than 11 hours for a complete exposition of the entire text, by which time the entire battle would have been lost.

Krishna Preaches Intolerance in Gita

sarva-dharmån parityajya måm ekam çaranam vraja

aham tvåm sarva-påpebhyo moksayisyåmi må sucah˙

(Bhagavad Gita – Chapter 18 – Verse 66)

(Abandon all types of dharma – come and surrender unto Me alone! Do not fear, for I will surely free you from all your sins.)

In this sloka, people are asked to abandon all other religious beliefs and accept the Hindu (Aryan) Gods and religion and all your sins will be washed.

Krishna is also threatening that someone who does not accept the Aryan religion are foolish, wicked, worst of human (naradhama). They are equivalent to ogre (asur/rakshasa) and they should be harmed.

na måm duskrtino müdhå˙ prapadyante narådhamå˙

måyayåpahrta jñånå åsuraµ bhåvam åçritå˙(7:15)

Desireless Karma (action): A reality check

karmany-e vådhikåraste må phalesu kadåchana

må karma-phala-hetur bhür må te sang’osva akarmani (2:47)

(Your right is to perform your work, but never to the results. Never be motivated by the results of your actions, nor should you be attached to not performing your prescribed duties.)

Let us see how far the Pandavas and Krishna himself acted on this principle of desireless action.

Did not the Pandavas, with the help of Krishna, fight with the desire to vanquish and kill their enemies ?

If they did not desire ardently to kill Dronacharya, why did they ask Yudhishtir to lie about the death of Dronacharya’s son “Ashwathama” ?

Why did Krishna by deceit make Jayadrath think that the sun had set and thus put him off his guard, and then shoot him with an arrow ?

Bhishma was killed because he would not fight Shikandi, who was born a female and later became a man and Arjuna sheltering himself behind Shikandi shot Bhishma in such an unchivalrous manner.

Were all these actions performed in a desireless manner regardless of the fruit of their actions ? Did practice follow precept ? Or, is it that Gods and the people blessed by Gods can do whatever they want with impunity, and do not have to practice what they themselves preach ?

So you can all see why the Gita is immoral.

Is this concept even feasible?

We drink water as it would result in quenching our thirst. We take food to survive. We take medicine so that we can get cured of our illness. We go to school to gain knowledge so that we can be in a profession of our choice. we go to work to earn our living.

In fact it is the desire for the fruit that motivates us to work better and harder.

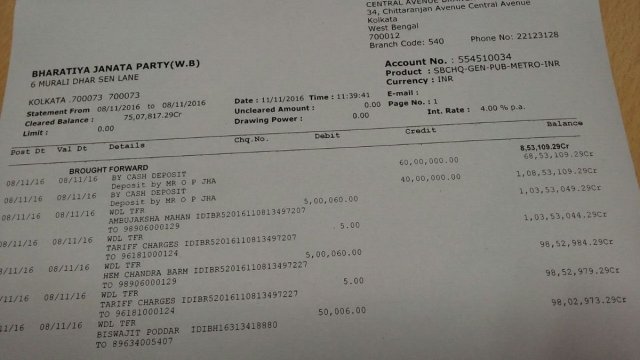

Political parties during election hold meetings, enhance public relations, bribe the media to propagandize in their favour, bribe the voters, organize a goons to rig the elections, and what not? Such huge ‘karma yoga’ without expecting the result to win the election and swindle 100s and 1000s of crores of public money?

The conclusion is Gita belongs to the genre of Panchatantra/Jataka tales, Aesop’s fables, Anderson’s fairy tales or Harry Porter’s escapades. Fun to read may be, but not to be taken seriously.

What, indeed, are the ethical values preached by Bhagavad Gita and Mahabharata?

- Murdering kinsmen and teachers to acquire lands you did not inherit, as being the illegitimate sons of a wayward woman.

- Sharing a common wife among all five of them.

- Hopeless gamblers ready to stake their wife.

- Casteist and unfair in competitions, are nobler than the sons of a devoted and chaste woman who went blind through her married life to emulate her blind husband and bore him many children who were charitable in their dealing with even a chariot-driver.

- Burning of an innocent Nishad woman and five kids just to fake their death.

- Killing – whether at war or otherwise – is an inconsequential thing.

- You shouldn’t worry about the results but do your duty.

What does that mean, how would one carry out his duty unless he has an idea about the expected results , if one did not have a motivation? Mr Modi, are you doing your duty as a minister without caring whether your country goes to dog?

Gita and caste system

Varna Dharma (Class System) and Jati Dharma (Caste System), two Brahmanic systems of ancient India have survived till date and became serious national disgrace.

The Varna Dharma, the system by which the Brahmanic society was divided into four classes, divided the society vertically (Brahmins at the top and Sudra at the bottom). Jati Dharma (1:43), the Caste System by which people identified themselves as belonging to a distinct group with shared values, hereditary professions, eating habits, food and marital alliances. (The Sanskrit word for caste, jati means “birth”)

Class (Varna) and caste (jati) began to form a single, though not yet a unified social system during Vedic era. But with the pre-Aryan and atheistic influence (like Buddhism and Jainsim) this varna/caste system was loosing its glory. So Krishna re-establishes the class-caste system through Gita.

cåtur-var√yaµ mayå s®ß†aµ gu√a-karma-vibhågaça˙

tasya kartåram api måµ viddhy-akartåram avyayam (4:13)

(I have created the four social divisions that are determined by the influence of the modes of material nature and their parallel activities. Although I have created this arrangement, know that in reality I am the non-doer and that I am unchangeable.)

So it apparently looks like that this varna system was based on the kind of professions people were into. For e.g. one who is a warrior by profession is a ‘Kshatriya’. But that is not true. All these professions were decided by birth. A son of a ‘sudra’ will always be a ‘sudra’ and cannot be a scholar or brahmin as a sudra does not have that Guna or quality in him. Thus varna(class) and jati (caste) system were one and the same.

The Gunas of Prakriti were unequally distributed as follows:

Brahmins were given Sattva Guna: Knowledge, purity, and happiness

tatra sattvaµ nirmalatvåt prakåçakam anåmayam

sukha-sa∫gena badhnåti jñåna-sa∫gena cånagha (14:6).

Kshatriyas were assigned Rajas Guna: Passion, thirst for power and wealth, and action.

rajo rågåtmakaµ viddhi t®ß√å-sa∫ga-samudbhavam

tan nibadhnåti kaunteya karma-sa∫gena dehinam(14:7).

Vaishyas and Sudras were given Tamas Guna: Heedlessness, indolence and sleep.

tamas tv-ajñånajam viddhi mohanam sarva-dehinåm

pramådålasya nidråbhis tan nibadhnåti bhårata(14:8).

Krishna came up with a pair of ingenious doctrines to explain the inequality of the Varna Dharma: unequaldistribution of one of three Gunas of Prakriti (“inherent Qualities”), and consequences of Law of Karma (“one’s current class and circumstances are as a consequences of one’s action in previous lives”). For example, Sudras, the lowest of four classes, were born in an “inferior womb” (Papayonaya, 9:32) because of the combination of their Tamas Guna (inherent traits such as ignorance, delusion, heedlessness, indolence and sleep, 14:8), and some sinful acts he must have committed in his previous lives, such as hitting a Brahmin or stealing his cow.

mån hi pårtha vyapåsritya ye’pi syu˙ påpa-yonaya˙

striyo vaisyås tathå südrås te’pi yånti paråm gatim (9:32)

Once born as a Sudra, he was forever condemned to be a servant of the upper classes. If a Sudra wished to be reborn in a higher class, he should keep performing his Dharma (designated duty of serving the upper classes) helplessly (18:60) and faithfully in this life (18:45).

svabhåva-jena kaunteya nibaddha˙ svena karmanå

kartum necchasi yan mohåt karisyasy-avasopi tat (18:60)

sve sve karmany-abhirata˙ samsiddhim labhate nara˙

svakarma-nirata˙ siddhim yathå vindati tacchrnu (18:45)

Gita brainwashed people into believing that one was totally helpless before the force of the Gunas (3:5, 27, 33; 18:60).

na hi kascit ksanam api jåtu tristhaty-akarmakrt

kåryate hy-avaça˙ karma sarva˙ prakrti-jair guna˙(3:5)

prakrte˙ kriyamånåni gunai˙ karmåni sarvaça˙

ahankåra-vimüdhåtmå kartåham iti manyate (3:27)

sadrçam cestate svasyå˙ prakrter jñånavån api

prakrtim yånti bhütåni nigraha˙ kim karisyati (3:33)

If one defied Varna Dharma, he would suffer shame in the society here on earth and hell hereafter (2:33). Ostracism by the society was considered worse than death (2:34).

atha cet tvam imam dharmyam sangråmam na karisyasi

tata˙ svadharmam kîrtim ca hitvå påpam avåpsyasi (2:33)

akîrtim cåpi bhütåni kathayisyanti te’vyayåm

sambhåvitasya cåkîrtir maranåd atiricyate (2:34).

Brahmanism condemned to hell those people, such as Buddhists, who were responsible for Varnasankara (1:42-44, class admixture).

sankaro narakåyaiva kula-ghnånåm kulasya ca

patanti pitaro hyesåm lupta-pindodaka-kriyå˙(1:41)

dosair etai˙ kula-ghnånåm varna-sankara-kårakai˙

utsådyante jåti-dharmå˙ kula-dharmåç ca såsvatå˙ (1:42)

utsanna-kula-dharmånåm manusyånåm janårdana

narake niyatam våso bhavatîty-anususruma (1:43)

aho bata mahat-påpam kartum vyavasitå vayam

yad råjya-sukha-lobhena hantum svajanam udyatå˙(1:44)

Being a patrilineal society, upper class men could marry lower class women, but upper class women were forbidden to marry lower class men (1:41) for fear of further decimation of the dwindling Arya upper classes, and destruction of longstanding Jati (caste) and Kula (family) traditions and rituals (1:43).

vidyå-vinaya-sampanne bråhman gavi hastini

çuni caiva çvapåke ca panditå˙ sama-darçina˙(5:18)

(A wise, learned, humble, brahmin sees a cow, an elephant, a dog, a lowborn person and all other living beings as equal.)

People who were outside the pale of these Brahmanic classes were considered as Outcastes (5:18), now known as Dalits (oppressed classes). In this Class System, Brahmins enjoyed a divine status.

The worst aspect of Varna Dharma has always been the existence of the Outcastes who later came to be known as Untouchables. These people were those locals who were too primitive to be part of Arya culture. These people performed menial tasks considered by Brahmanism as degrading, such as skinning animals, carrying out night soil, cremating dead bodies, executing criminals, and other unsavory tasks, which even Sudras refused to do. People known as Chandala belonged to this category. People resulting from Varnasankara such as the union of the Brahmin women and Sudra men were also considered as Outcastes. Brahmins shunned Untouchables so scrupulously that even their shadow was not allowed to fall on them. So Untouchables lived in their own humble colonies outside the village limits. This is still the case in many parts of India. Often high walls separated the upper class dwellings from those of the Outcastes. Often Untouchable were required to use separate roads. Varna Dharma has always been sacrosanct to Brahmanic loyalists simply because it gave Brahmins high status and power in its hierarchy.

The abomination of Varna Dharma did not go unchallenged in ancient India, which was full of freethinking, humanitarian and righteous people such as Charvakas, Jains and Buddhists, who abhorred Brahmanism and its whole range of shenanigans. These groups abandoned Brahmanism as well all its sub Dharmas.

Atrocities Against Dalits Are Common

Over the past three millennia, millions of aggrieved people, designated by Brahmanism as Untouchables, have suffered untold injustice and atrocity in the hands of the Brahmanic “upper classes.” This problem continues in India even to this day with overt or covert support of Brahmanic leaders. Today you cannot open an Indian newspaper without reading some type of atrocity against Dalits. From time to time, we hear about lynching of Dalit men and rape of Dalit women by Brahmanic gangs. Do a Google search on “Lynching of Dalits” and see how many hits you get. All over India today, we can see such atrocious behavior even among the so-called educated people who are not able to raise themselves above the low-minded behavior engendered by Brahmanism. Yet you will never hear one word of reproach from a single ‘holy’ and ‘triple’ or ‘quadruple Sri’ Swami or Guru of Hinduism against such inhumanity. They are so busy preaching the world of wonderful “Hindu Wisdom and Spirituality” that they have no time whatsoever to issue a condemnatory statement on such trivial matters as lynching of Dalit men or gang rape of Dalit women by upper caste mobs. And the silence of the Hindu majority, which raises hue and cry when a bicyclist accidentally knocks down an emaciated cow, is deafening.

Government’s Indifference To Institutionalized Untouchability

The mistreatment of Dalits is not just an individual incident. Often it is institutionalized with studious indifference, or full backing, of the government machinery dominated by the upper classes. In such cases, the government officials are either gutless to intervene, or are in cahoots with the upper classes.

Lynching of boy underlines how the curse of caste still blights India

Sai Ram, burned alive because of a stray goat, was just one of 17,000 Dalits to fall victim to caste violence in the state of Bihar. (The Guardian, October 19, 2014 link)

Madurai’s Wall Of Shame Still Stands

CPM leader Brinda Karat on Saturday decided to do a reality check at the village in Madurai where the wall of shame that divided Dalits and dominant communities was brought down in 2008.

Things seem to have got worse now. Dalits can’t walk on the road meant for upper castes, they have a separate ration shop and a separate school for their children. (NDTV: Sam Daniel, Saturday September 12, 2009, Madurai link)

Righteousness and the rich are identical

prāpya puṇya-kṛtāḿ lokān

uṣitvā śāśvatīḥ samāḥ

śucīnāḿ śrīmatāḿ gehe

yoga-bhraṣṭo ’bhijāyate (6.41)

(The unsuccessful yogi, after many, many years of enjoyment on the planets of the pious living entities, is born into a family of righteous people, or into a family of rich aristocracy.)

Gangstars like Daud Ibrahim are rich and hence righteous. Despite Jesus’ saying that the rich would not go to heaven just as a camel cannot pass through a needle-hole, there are many passages in Bible that agree with this view.

Lowest class of humans – women, trading class and the Shudras might go to heaven by worshiping Krishna

māḿ hi pārtha vyapāśritya

ye ’pi syuḥ pāpa-yonayaḥ

striyo vaiśyās tathā śūdrās

te ’pi yānti parāḿ gatim (9.32)

(O son of Pritha, those who take shelter in Me, though they be of lower birth—women, vaishyas [merchants] and shudras [workers]—can attain the supreme destination.)

So the holy book says that women, vaishyas and shudras are the lowest class of humans. Even the lowest class of humans – women, trading class and the lower castes in that order -might go to heaven by worshiping Krishna.

Science and Bhagavad Gita

Seven Rishis (Saptarshis) and four Manus were born from Krishna’s mind; all creatures were born from them.

maharṣayaḥ sapta pūrve

catvāro manavas tathā

mad-bhāvā mānasā jātā

yeṣāḿ loka imāḥ prajāḥ (10.6)

(The seven great sages and before them the four other great sages and the Manus [progenitors of mankind] come from Me, born from My mind, and all the living beings populating the various planets descend from them.)

That means the theory of evolution is all wrong – what is right is that seven Rishis (Saptarshis) and four Manus were born from Krishna’s mind and all creatures of the world were born from them. Oh, God, why did I study science? If Bhagavad Gita is true, aren’t that implying that science is bullshit?

Wind, after blowing everywhere, rests in the sky and that the rain is a result of yajna or sacrifice

yathākāśa-sthito nityaḿ

vāyuḥ sarvatra-go mahān

tathā sarvāṇi bhūtāni

mat-sthānīty upadhāraya (9.6)

(Understand that as the mighty wind, blowing everywhere, rests always in the sky, all created beings rest in Me.)

annād bhavanti bhūtāni

parjanyād anna-sambhavaḥ

yajñād bhavati parjanyo

yajñaḥ karma-samudbhavaḥ (3.14)

(All living bodies subsist on food grains, which are produced from rains. Rains are produced by performance of yajna [sacrifice], and yajna is born of prescribed duties.)

Should we teach our young students that the mighty wind, after blowing everywhere, rests in the sky and that the rain is a result of yajna or sacrifice? Wondering if believers of Bhagavad Gita encourage their kids to write these in their science examination paper about the cause of rainfall.

Vedas are flowery nonsense

According to Bhagavad Gita, Vedas are flowery nonsense designed for gratification of senses.

yām imāḿ puṣpitāḿ vācaḿ

pravadanty avipaścitaḥ

veda-vāda-ratāḥ pārtha

nānyad astīti vādinaḥ

kāmātmānaḥ svarga-parā

janma-karma-phala-pradām

kriyā-viśeṣa-bahulāḿ

bhogaiśvarya-gatiḿ prati (2.42-43)

(Men of small knowledge are very much attached to the flowery words of the Vedas, which recommend various fruitive activities for elevation to heavenly planets, resultant good birth, power, and so forth. Being desirous of sense gratification and opulent life, they say that there is nothing more than this.)

However, Bhagavad Gita contradicts the above verses and says that Vedas are the fountains of knowledge directly manifested by God himself

karma brahmodbhavaḿ viddhi

brahmākṣara-samudbhavam

tasmāt sarva-gataḿ brahma

nityaḿ yajñe pratiṣṭhitam (3.15)

(Regulated activities are prescribed in the Vedas, and the Vedas are directly manifested from the Supreme Personality of Godhead. Consequently the all-pervading Transcendence is eternally situated in acts of sacrifice. That the greatest sinner can sail through the miseries of punishment by simply acquiring knowledge of scriptures? Haven’t we read that elsewhere – in the Bible, for instance?)

Bhagavad Gita teaches us that we should all lose interest in others, shed attachment to our families, discard our senses and seek self-realization. (Everybody speaks of self realization as a great goal but what, indeed, is that? Simply put, you don’t know who you are, and need to become a yogi to find that out? )

According to Bhagavad Gita, casteism is the most essential need of the society; destroying caste system would take those responsible to hell. (Arjuna to Krishna Chapter 1.42,43) or that mixing – interbreeding between castes – (Sankara) of varnas (castes) would be a terrible thing to happen (Krishna to Arjuna)?

doṣair etaiḥ kula-ghnānāḿ

varṇa-sańkara-kārakaiḥ

utsādyante jāti-dharmāḥ

kula-dharmāś ca śāśvatāḥ (1.42)

utsanna-kula-dharmāṇāḿ

manuṣyāṇāḿ janārdana

narake niyataḿ vāso

bhavatīty anuśuśruma (1.43)

According to Bhagavad Gita, discrimination among men is God(Krishna)-ordained, based on character and deed and is hence sacrosanct.

catur-varn?yam´ maya sr?s?t?am´

gun?a-karma-vibhagasah?

tasya kartaram api mam´

viddhy akartaram avyayam

(According to the three modes of material nature and the work associated with them, the four divisions of human society are created by Me. And although I am the creator of this system, you should know that I am yet the nondoer, being unchangeable.)

An evil-doer will be forgiven and sent to heaven by worshipping Krishna single-heartedly (9.30)?

api cet su-durācāro

bhajate mām ananya-bhāk

sādhur eva sa mantavyaḥ

samyag vyavasito hi saḥ (9.30)

(Even if one commits the most abominable crime, if he is engaged in devotional service he is to be considered saintly because he is properly situated in his determination.)

Didn’t Jesus’ God and Allah say the same thing? Why do you think George Bush, Osama Bin Laden and Narendra Modi –not forgetting Daood Ibrahim – look so smug in their photographs? They are all pious men, and will go to Heaven while Pandit Ishwar Ch. Vidyasagar, our godless social reformer won’t – his enormous social work has no meaning to God. Looks like I could keep him company in hell.

Sit on a deer’s skin to practice yoga and to meditate upon Krishna

śucau deśe pratiṣṭhāpya

sthiram āsanam ātmanaḥ

nāty-ucchritaḿ nāti-nīcaḿ

cailājina-kuśottaram

tatraikāgraḿ manaḥ kṛtvā

yata-cittendriya-kriyaḥ

upaviśyāsane yuñjyād

yogam ātma-viśuddhaye (6.11-12)

(To practice yoga, one should go to a secluded place and should lay kusa grass on the ground and then cover it with a deerskin and a soft cloth. The seat should be neither too high nor too low and should be situated in a sacred place. The yogi should then sit on it very firmly and practice yoga to purify the heart by controlling his mind, senses and activities and fixing the mind on one point.)

Why persecute actor Salman Khan, who was probably trying to get one of those God-ordained deer skins to use as his prayer mat?

Hate Speech to eliminate religious minorities

Pravin Togadia, the leader of the right-wing Hindu organisation, Vishwa Hindu Parishad (VHP), in India has called for eviction of Muslims from a Hindu area in the western state of Gujarat.

“We should have it in us [Hindus] to take the law in our own hands in an area where we are a majority and scare them [Muslims],” he told supporters, according to the Times of India report on Apr 21, 2014.

Reports said that Togadia allegedly insisted that Muslims be stopped from “buying Hindu properties” and that a Muslim family which had bought a home in one such area be forcibly evicted.

Pravin Togadia has been the leading person in making hate speeches; he has the highest number of cases regarding hate speech against him.

One recalls even before Modi Sarkar assumed the seat of power the divisive activities of ‘BJP associates’ in the form of propaganda of love jihad and Ghar Vapasi were on, and they continued without any respite during this year. Soon after this Government came to power in Pune, Mohsin Sheikh, a person working in IT was hacked to death by activists of Hindu Jagran Sena, in the aftermath of morphed pictures of Bal Thackeray and Shivaji being posted on the social media. The attack on Churches was very glaring and the process which was dominant in Delhi and Haryana was also witnessed in places like Panvel near Mumbai, Agra in UP amongst other places.

Sakshi Maharaj not only said that Godse was a patriot; he also went on to say that Hindu women should produce four children, as Muslims are overtaking the population. Sadhvi Prachi went to prescribe eight children for Hindu women. She also gave a call that the Muslim film actors, Aamir Khan, Shahrukh Khan and Salman Khan should be boycotted.

Yogi Adityanath, BJP’s MP keeps making very derogatory remarks, He said that in ‘love jihad’ if one Hindu girl is converted then 100 Muslim girls should be converted to Hinduism. The propaganda around love jihad keeps simmering and various small and big leaders keep using it to divide the society. Same Yogi went on to say that Mosques should be converted into den of pigs and that Muslims should not be allowed to come to Hindu holy places.

Amit Shah, the BJP’s National President has given a clean chit to Baba Ramdev over his expressly uttered fantasies to ‘chop of heads of any and all, especially those in the much-loved skull caps, who refuse to utter Bharat Mata Ki jai.”

The Hindu: Amit Shah backs yoga guru Ramdev

Who better than Amit Shah to play judge and jury on hate speech?

In April 2014, during electioneering for the Lok Sabha Polls he made his famous ‘Revenge Speech” in Shamli. Shamli one of four districts of western Uttar Pradesh was swept by brute violence in September 2013 that left over 60 dead, over ninety per cent Muslims. The count of how many lost their lives, incidentally, by rights activists and the figures presented in court are much higher. The violence had also contained the characteristic revenge rapes of young Muslim women and girls and widespread displacement from which the local community still reels. Not just the ruling Samajwadi party, but sections of the BJP have been held responsible for the violence.

Religion propagates terrorism and violence

At the time when Union External Affairs Minister Sushma Swaraj is urging the Centre to declare the Bhagvad Gita the national scripture, Rashtriya Swayamsevak Sangh chief Mohan Bhagwat said that, “the Hindu scripture is not read as much as it is supposed to be. There are countries practicing the ethics of Gita.” He wholeheartedly wants Bhagvad Gita to be the national scripture, ” who ever is against it should leave the country.”

Bhagwat is probably right in saying that there are countries practicing the ethics of Gita. Pakistan, for example. Sudan, till last decade. Afghanistan, under Taliban. Former Republic of Yugoslavia. Like them, saffron brigade can’t tolerate a different opinion, a different view.

Why, Mr. Bhagwat, waste your time persuading the non-believers to get out of the Country? Why not do the duty that Lord Krishna cajoled Arjuna to carry out – like, say, you did in 2002 in Gujrat?

Even after the unholy and treachearous war was won, Pandavas did not give up

their duty of killing those who were not with the philosophy of Gita. Charvaka, who argued with logic against Brahminism and their concept of God was burnt alive in Yudhishtira’s court. A prelude to Goa inquisition. Like Hindus admire Pandavas, Catholics praise St. Xavier and worship his shriveled body kept in an airtight casket and put on show periodically. It was Xavier who inspired the first holocaust in history.

Mr. Mohan Bhagwat, I could go on citing verses from the Gita that you have never read. But it would serve no purpose.

Not long ago I met a young boy – perhaps not older than 11 or 12 – reciting Quran aloud from memory at Dhaka airport. A couple, obviously his parents, were beaming with pride.

“Does he know the whole Holy Quran?” I asked the father.

“Of course. Not just Quran” He whispered a few holy words on mentioning the name. “He is first in school in all subjects. English, Bangla, science – everything.”

The boy had paused.

“Son,” I said, “what would you wish to be when you grow up – a doctor, scientist – or what?”.

“A preacher,” he said without hesitation. “I want to spread Islam throughout the world.”

“What if some people resist?”

The boy looked agitated. “I’ll kill the haram kafirs,” he said.

He must have grown up now. He might by now hopefully had moderate his view and only demand that non-believers leave the country.

Just after I wrote that reminiscence about the Dhaka boy, came the news of another Nishkama karma – action without desiring results. Anis Amri, a 24-year old Arjun had driven a lorry into a crowded Christmas market in the heart of Berlin, killing 12 and injuring 49 in the name of an ideology of Islamic extremism, an ideology very similar to that of Mohan Bhagwat-Pravin Tagodia and company.

Religion has caused more harm to mankind than good. Let’s march towards a religion free-god free happy world.

References:

- https://srimadbhagavadgita.net

- http://www.gitaaonline.com/chapter-verses/

- Bandapadhyaya Jayantanuja: Samajabijnanera drshtite Bhagabadgita.

- Bhattacharya Sukumari: Gita Keno

- Narendra Modi’s speeches on Godhra Riots

After a number of media reports on Narendra Modi’s inflammatory speeches against the minorities, the National Commission for Minorities (NCM) asked the Gujarat home department on September 10, 2002, for a copy of the speech made by the CM at Becharaji, a temple town in Mehsana. Attempting to block such information, the Gujarat government claimed that it had been unable to trace a copy of the speech.

The state home department ensured that its stooge DGP, K. Chakravarti, endorsed the fact that the state intelligence department, headed by the then ADGP, RB Sreekumar, was not required to provide such a report. But Sreekumar felt duty bound to comply with the request of the NCM. He obtained a copy of the speech and forwarded it to the commission soon after. This proved to be a costly move for him. Sreekumar was immediately transferred out of the intelligence department to a relatively insignificant post.

In his speech of September 9, 2002, an unapologetic Modi makes several disparaging remarks about the minorities and offers indirect justification for the anti-Muslim violence. He further ridiculed the plight of the refugees and victims of the violence who still lived in relief camps.

The excerpts from the speech are as follows:

“…….We are accused of being Hinduwadis. Oh, brothers! Our government has allotted eight crore rupees for the development of Becharaji Devi temple. Have we committed a crime? Have we become communal by allotting eight crore rupees for the development of Becharaji?

Our Congress friends say Narendrabhai has brought Narmada water to the Sabarmati river and this man is so clever that he brought it in the month of Shravan. Let me ask my Congress friends a question: if water is brought during the month of Shravan, those mothers/ladies residing on the banks of the Sabarmati river can bathe in Narmada water and feel holy and blessed. So how does it hurt them? Since we (BJP) are here, we brought water to the Sabarmati during the month of Shravan, when you (Congress) are there, you can bring it in the month of Ramzan!

When we bring water in the month of Shravan, you feel bad. When we spend money for the development of Becharaji, you feel bad. What, brother, should we run relief camps? (At the time, tens of thousands of Muslims, rendered homeless during the carnage, were still living in relief camps.) Should I start baby producing centres there? If we want to develop Gujarat… we need to teach those people (Muslims) who are expanding their population a lesson.

In Gujarat, madrassas are coming up in large numbers. Children have the right to primary education. But a madrassa-going child is deprived of primary education. What will such a child do when he grows up? What if normal education was not available and only religious education was available; would this not be a burden on Gujarat?

We cannot permit merchants of death to operate freely in Gujarat. I may lose the chair but I will not allow those plotting to destroy Gujarat and harm the innocent to carry out their plans. The days of somebody like Dawood Ibrahim sitting in Karachi and playing games of murder and destruction are over.”

“Tongue of Flame” by Teesta Setalvad in Communalism Combat: June, 2009 which outlines Modi’s inflammatory speeches demonising the Muslims before, during and after the communal violence in Gujarat can be accessed athttp://www.sabrang.com/cc/archive/2009/may09/cover5.html

Shishir K Bajoria belongs to one of the oldest business families in Kolkata trading in jute and tea. He is the promoter of SK Bajoria Group, which has steel refractory units in six countries with an annual turnover of $200 million.

Shishir K Bajoria belongs to one of the oldest business families in Kolkata trading in jute and tea. He is the promoter of SK Bajoria Group, which has steel refractory units in six countries with an annual turnover of $200 million.