“It is true that the immediate impact (4 to 5 months) of demonetisation is surely negative in the form of slowdown of consumer spending, severely affecting the highly cash oriented industries like real estate, jewelries, textile etc along with a crawling GDP growth. But this is a 5-6 months transition period. After which a massive amount of capital will be transferred into d banking system and Indian economy will boom.”

-This is what my friend Kalpita Mahajan told me just couple of days back. She had also send me a video of Amit Rathi, where Rathi talks about the same. You can watch that video here.

Kalpita is a member of Rationalists’ and Humanists’ Forum of India and is a rational person to the core. She accepts facts only after meticulous research. Despite when someone like Kalpita can get confused that demonetisation will boost Indian economy, many people would have same kind of believe. So it is essential to analyse the claims.

Who is Amit Rathi?

Amit Rathi is the Managing Director of Anand Rathi Financial Services. According to his Linkdin profile,

Anand Rathi is a leading Indian player in private wealth management, investment banking, brokerage and capital markets lending with 150 offices across the country with presence in the UAE, US and UK through affiliates and a team strength of over 2,500 professionals.

The Anand Rathi PWM business is a market leading advisory service serving the wealth management needs of HNI families across its offices in Mumbai, Bangalore, Delhi, Hyderabad, Chennai and Pune.

Amit Rathi is also infamous in connection with the Rs 5,600-crore scam at National Spot Exchange Ltd. One can know more by visiting the links given below.

NSEL: Anand Rathi Raided, Money Laundering, Auditors Flee

NSEL scam: Court extends Amit Rathi’s police custody till March 13

Lets us not deviate our discussion to whether he has professional motives to make such claims. Rather we will stick our discussion to analyse the claim that ‘it would boom Indian economy’.

Demonetisation: Will it boost Indian economy?

People who say that this will boost the economy believes that a massive amount of capital will b transferred into the banking system in the following way:

1)the taxes on the unaccounted money along with the penalties.

2)worthless currency notes expiring on 31st mar 2017 (which people decided to keep as it is neither declared nor utilised other way) as a written off liability for the RBI.

The unearthed money supply will boost up the economy.

1)inflation will start to fall because of increase of d legitimate huge money supply .

2)huge taxes will b deposited on an yearly basis.

3) interest rate will drop because of favourable monetary demand supply equation.

4)companies can expect a higher profit because of a lower interest rates.

5)a overall economic boost up will follow.

The above points are based on the concept that “black money” consists of hoards of cash which are kept hidden inside the wall or pillowcases or buried under the earth. As 500 and 1000 rupee notes are demonetized, then people with black money going to banks to exchange large amounts of old notes for the new legal tender would make the banks suspicious; and banks in turn would convey their suspicions to the tax authorities who would then catch the culprits. “Black money” would thus get exposed.

This argument, that ‘the demonetization of 500 and 1000 rupee notes is an attack on black money and will boost Indian economy in near future’, is based on an utter lack of understanding of “black money” and “parallel economy system.”

It is based on wrong assumption that “black money” actually consists of hard cash, where as in reality as stated by ED and RBI, only 6% of total black money economy is in hard cash. Now if a person possesses, say, unaccounted money of Rs.20 crores, and that too in 500 and 1000 rupee notes, then such a person instead of going to the bank with the entire Rs.20 crores, will send several people to the bank, each carrying a small amount, and would do so over a number of days prior to the December 30 deadline.

In fact even this long process would be unnecessary. All sorts of intermediaries would come up fairly soon who would do this job of exchanging old notes for new ones on behalf of customers for a consideration.

Read here: Currency Exchangers Make A Killing, Buying Old 500 Rupee Notes And Paying Only Rs 300 In Return

Understanding black money and parallel economy system

It is the money generated from completely illegal activities such as arms smuggling or drug paddling. Alternatively, money activities which are legal but nonetheless undeclared because they want to avoid taxes. So we need to understand the concept of black money as a parallel economy system consisting of illegal business and undisclosed business.

Black business or white, are meant to earn profits for those engaged in them; and simply keeping the money buried under the ground, earns no profits. Profits are earned not by hoarding money but by throwing it into circulation.

An enormous amount of black money flows in and out of the banking system and still remains black. A government official can take his family out for a lavish meal at a five-star hotel or buy the choicest Scotch whisky from liquor shops with cash taken as bribe. Once these sales enter the books of the hotel chain or the legitimate foreign liquor importer who pay taxes, the black money becomes “white”. Then if the hotel chain’s or the liquor importer’s liaison person pays a bribe to any official functionary (there are ingenious ways of cloaking it as a legitimate cashless transaction), the amount paid, which will not be declared by the official as income to the tax authorities, becomes black money again.

The concept of “black money” is that it is held while “white money” is used for circulation, is completely wrong. The success of unearthing “black money” lies therefore in tracking down “black business”, not in attacking money-stock.

Modi did nothing to stop the generation of black money. One would still need to bribe to get his work done in a government office.

BJP had termed demonetisation as ‘anti-poor’ in 2014

The Bharatiya Janata Party actually came down hard against demonetisation not too long ago and slammed it as anti-poor, when UPA government pushed for a similar move in 2014.

This was just four months before Modi was elected PM. In January 2014, the Reserve Bank of India announced all currency notes issued before 2005 would be withdrawn completely from circulation. The then Prime Minister Manmohan Singh did not appear on television to announce the move. That was not needed because the withdrawal was to be done in a phased manner, over the next three months.

But the BJP had to play the role of a vocal opposition then and slammed the move left, right and centre. Meenakshi Lekhi, now the Lok Sabha member from New Delhi but then only a party spokesperson, said 65% Indians who did not have bank accounts and are largely illiterate, poor, old and living in remote areas, store their money in cash.

Lekhi even wrote an article for the Economic Times. “The latest gimmick of finance ministry… an attempt to obfuscate the issue of black money stashed outside the country.” she said.

You can read her article here.

Watch Minakshi Lekhi’s Full speech on demonetisation! Press conference Jan 23, 2014.

Demonetisation and ‘counterfeit currency’

The government has said one of the reasons to demonetise notes of Rs. 500 and Rs. 1,000 was to curb the circulation of fake currency.

Some very fundamental questions would be:

- How did the fake currencies get into the system at all?

- What steps are being taken to ensure that new currency bill will not be faked?

- If government is taking the steps now that will ensure that fake currencies does not get into the system, why was it not done before?

- How sure is our government that the new Rs 500 and Rs 2000 bill will not be forged?

We have been having old currency disappearing, new currency notes coming into being. But that did not solve the problem of counterfeiting notes. The new currency was forged. Even now, the new Rs 500 and Rs 2000 bill will get faked and will enter the system, the same way counterfeit notes entered into the system before.

Let us assume that new Rs 500 and RS 2000 cannot be forged. In that case, this is a matter which could have been done in the normal course over a period of time, without putting people into inconvenience.

But have some particular motives in demonetising and solving the problem of counterfeit notes or curbing black money is not in that list.

Read: Fake Rs 2,000 banknotes already? Unsuspecting Karnataka farmer falls victim

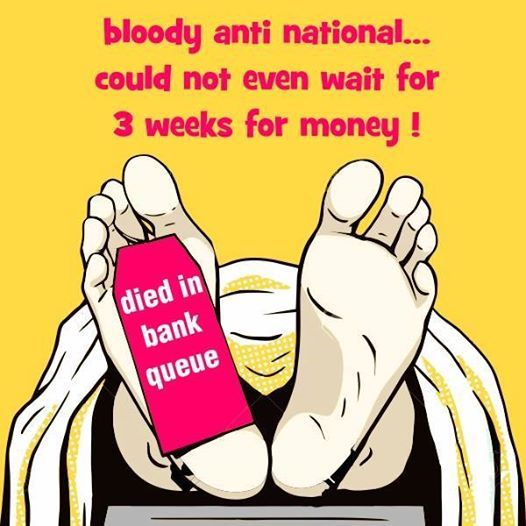

Demonetisation has hit not the black money hoarders but the Poor

For the last few days millions of Indians are waiting in long, unending queues to recover their own money from banks, post offices and ATMs. The government at the Centre remains firmly in denial about the untold hardship to the poor who cannot afford to stay away from their daily wage work even for a day. Some senior citizens have died of exhaustion standing in queues for hours on end. Families have suffered as private hospitals refuse to take currency notes of 1000 and 500 denomination, legal tender just till the other day.

To rub salt in their wounds Prime Minister Narendra Modi, on a visit to Japan, makes a statement that he had anticipated short term pain to the ordinary people and goes on to warn that even harsher measures could come to tackle black money in the near future. Meanwhile, the finance minister Arun Jaitley goes about his daily briefings spouting platitudes about how the people are willing to suffer some pain to promote the larger cause of fixing the black economy.

Farmers have only one thing on their mind: how to buy seeds for sowing. As they spend most of their time queuing up at banks, with many of them returning empty-handed, time is fast running out for farmers.

The latest count of reported deaths across India that have been linked to the demonetisation chaos is 55. Mostly, it was elderly people died waiting in the queues to draw money from their own bank accounts, or to exchange their own old Rs 500, Rs 1,000 notes.

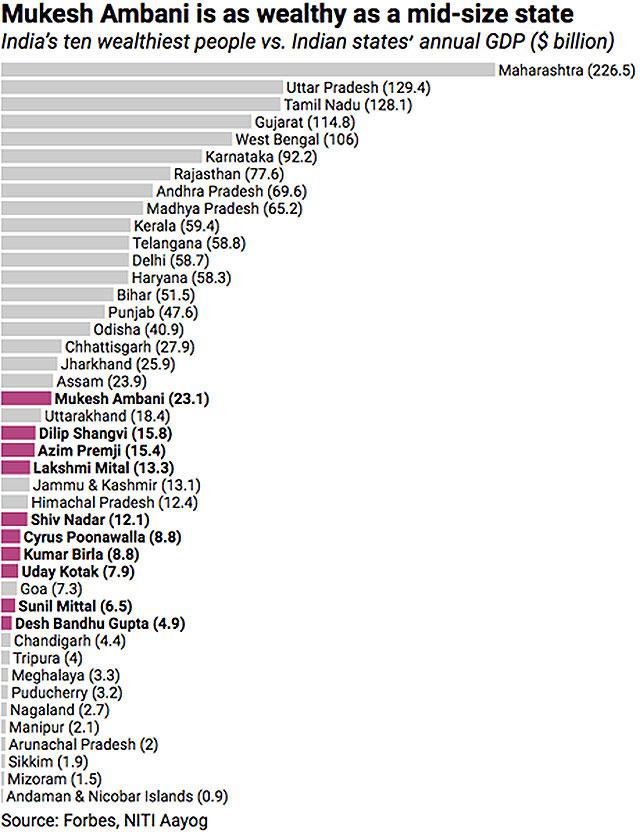

Karnataka-based politician and mining baron, G Janardhana Reddy spent just Rs 550 crore to arrange the wedding spectacle for his only daughter, Bramhani, on Wednesday — a wedding attended by politicians from both the BJP and the Congress.

There aren’t any examples better than this to depict how the rich and poor in this society have been treated by Modi’s historic demonetisation exercise. Those 55 who died from exhaustion and trauma in long queues and the Reddy wedding are two ends of this society in which we live. These figures tell us how the ‘rich and the powerful’ couldn’t care less about the cash crunch and how it is the common man, who is the actual sacrificial goat.

Reddy is only a symbol of a club of the rich and politically-powerful in this country. This club never bothered about Modi’s currency ban.

How did Reddy manage Rs 550 crore for his daughter’s marriage extravaganza? If this entire sum was plastic currency or electronic currency, Reddy holds the answer to how to turn India’s deeply-locked cash economy into a cashless one in a matter of days — he should be made the Union finance minister or Reserve Bank of India (RBI) governor, as the incumbents in these positions are struggling to achieve this goal.

Or else, even if a fifth of the money Reddy spent was in cash and if we assume that all of these aren’t Rs 100, Rs 50 and Rs 10 notes that Reddy had stored in his secret chamber before the currency ban, then the following question arises: How did Reddy manage to get new currency of Rs 100 crore or more when common man is forced to stand in queues for hours before so much as a glimpse of new currency notes or even the old Rs 100 note?

Did some banker or a childhood friend in the government help Reddy to get what was required to pay for the Rs 550-crore wedding gala?

The answer should come from the Income Tax Department, the police, the financial intelligence unit and ultimately, the Narendra Modi government.

The amount Reddy spent — Rs 550 crore — would fill 27,500 ATMs across the country. While the Reddy gala took place in Karnataka, there were many fathers who committed suicide across the country, as they couldn’t buy groceries or to meet other expenses for their daughters’ weddings. The loss of lives cannot be treated as a temporary pain; the issue is very serious.

A death count of 55 or so — as is being reported — happens only when there is a natural calamity or a vehicle mishap or a bomb blast, not when a “well thought-out” economic reform gets implemented by a government. No matter the long-term benefits of the demonetisation exercise, the Modi government is answerable for the difficulties and loss of lives the common man has faced in the days since the announcement.

Black money is the life blood of the political parties

In part 1, I Quoted the information by the Association of Democratic Reforms (ADR) — that in 2013-14, political parties, in their income tax returns, had declared a total income of Rs 1,519 crore (the BJP had the highest share of Rs 674 crore while Congress came second with a collection of Rs 598 crore). But income from unknown sources amount to more than 70 percent of their total income. All such contributions were in cash.

All those who ply their black money into the coffers of the political parties in cash remain unidentified. Such illegal contributions come from two sources: First, big and medium business houses which make cash donations and keep it off their respective balance sheets. Second, wealthy individuals who make similar donations in cash. This is clearly in exchange for quid pro quo.

That explains why when more than Rs 2 crore went missing from the headquarters of the BJP in Ashoka Road in Delhi in 2008, the party decided not to file a police complaint.

But then BJP is not the only party that thrives on black money. Congress, which ruled for decades in both the Centre and several states, had made cash transactions, the life-blood of its party organisation. Most other parties which fulminated against the corrupt ways of the Congress followed its lead in institutionalising corruption in their respective party framework.

Under the aegis of the Congress government, Section 13A of the Income Tax Act enacted in 1961 exempted political parties from paying income tax. Political parties were given 100 percent tax exemption from all sources of income. The only condition stipulated in the Act (Section 139 4B) was that the political parties would be required to file income tax returns in a prescribed format every financial year, failing which the exemption would be withdrawn.

Despite such mandatory requirement, all the political parties, both national and regional, refused to file income tax returns for years but continued to enjoy income tax exemptions. This was absolutely illegal, but both the ruling and opposition parties were in cahoots to continue the illegality and the government agencies were either coerced or bribed to hold their peace.

This went on for several years till 1996, when the Supreme Court, responding to a public interest litigation filed by the Common Cause (headed by HD Shourie) gave a clear direction that the political parties failing to file income tax returns would not be covered under the Section 13A of the Income Tax Act.

The parties were then left with no option but to file their I-T returns. But since I-T returns used to be a closely guarded secret in India, that remained confined to the files of the officials who merely acknowledged the receipt of the annual returns. That brought the situation back to square one – parties could sit pretty by making any arbitrary claims, but did not have to account for it.

After the Right to Information Act was passed in 2005, the Association of Democratic Reforms (ADR) sought the copies of the I-T returns of different parties under the same Act. But the income tax department – used to the secretive manner of its functioning over the years – refused to oblige saying that information containing details of commercial activities of political parties were exempt under the RTI Act.

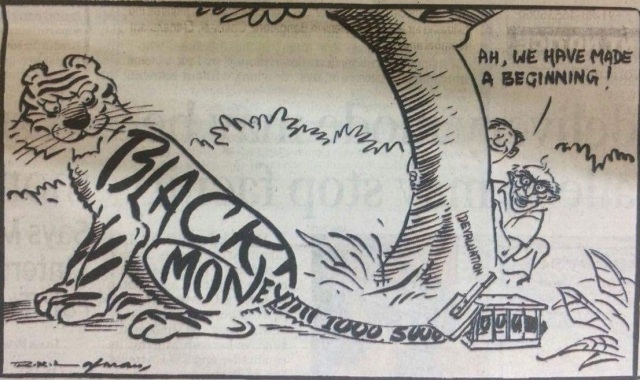

RK Laxman’s 1978 cartoon perfectly sums up today’s demonetisation

The ADR then moved the Central Information Commission. Most political parties, including the Congress and the BJP but excluding the Communist parties, raised their objections to the ADR appeal before the CIC on the grounds of infringement of privacy. The CIC, however, overruled the objections saying that political parties could not claim special privileges while being very much an integral part of the public life. In its order dated 29 April, 2008, the CIC directed the income tax authorities to provide to the petitioner the details of the tax returns of political parties within six weeks.

This decision was a major setback to the parties. But the greater setback came when the full bench of the CIC, in its order on 3 June, 2013, directed that six parties – Congress, BJP, CPM, CPI, NCP and BSP — be designated as public authorities under the RTI Act. “The presidents, general secretaries of these parties are hereby directed to designate CPIOs and appellate authorities at their headquarters in six weeks. The CPIOs so appointed will respond to the RTI applications extracted in this order in four weeks time,” the bench directed.

The Manmohan Singh government then considered the proposal to either issue an ordinance to nullify the CIC order or to amend the RTI Act itself to the effect that political parties were out of the purview of the RTI Act. But before it could act, the UPA went out of power.

In any case, the national parties had chosen not to comply with the CIC order. RTI activist Subhash Chandra Agrawal and Anil Bairwal of the ADR, the original petitioners to the CIC, moved the Supreme Court. In August 2015, the Narendra Modi government made it clear in its submission to the apex court that it was on the same page with the previous Manmohan Singh regime in opposing the CIC stance. Since then the matter is pending before the highest court of the land.

It is shameful that both Manmohan Singh and Narendra Modi – and their finance ministers P Chidambram and Arun Jatley respectively — made big promises in eradicating the menace of black money, but when it came to their respective political parties – which are the biggest den of the black money – these national leaders have been stubbornly refusing to come clean.

Surgical strike on black money!! or….???

Black money thrives because it plays a critical role in Indian elections and no political party of any consequence appears interested in putting an end to this.

Political parties thrive on black money. So none of the political parties taking part in electoral process would make a sincere attempt to eradicate black money.

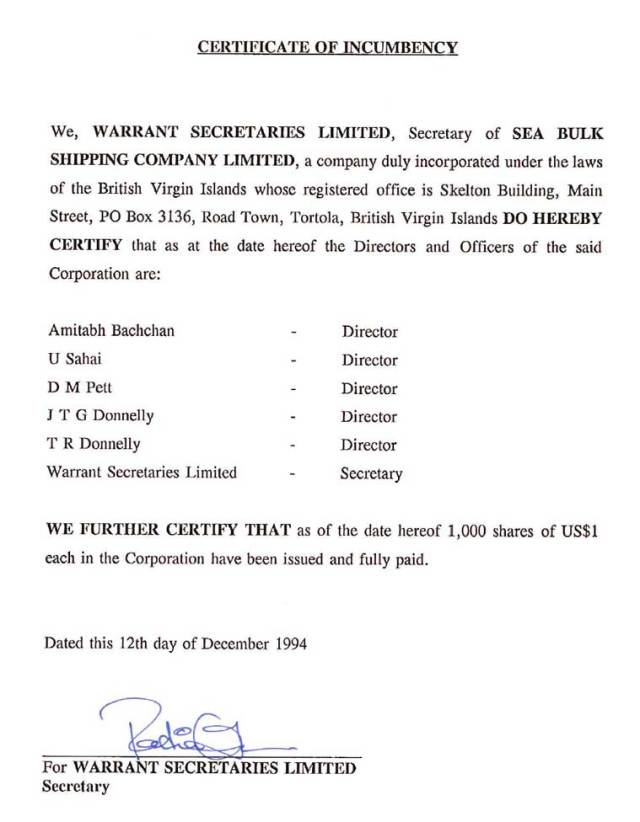

Panama Papers

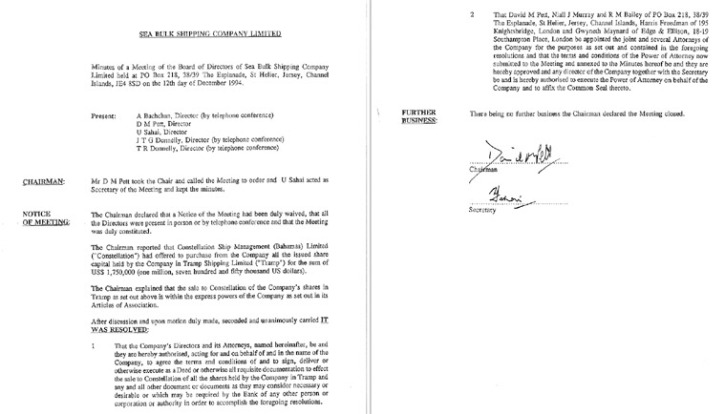

The Panama Papers are an unprecedented leak of 11.5m files from the database of the world’s fourth biggest offshore law firm, Mossack Fonseca.

The documents show the myriad ways in which the rich can exploit secretive offshore tax regimes.

Former Miss World and actress Aishwarya Rai, her father-in-law Amitabh Bachchan, businessman KP Singh of the DLF group, Sameer Gehlaut of the Indiabulls group, and Vinod Adani of the Adani group are among the 500 Indians linked to offshore firms set up in tax havens such as British Virgin Islands and the Bahamas.

Other well known names on the list include the Mumbai-based Garware family, Goa-based industrialist Anil Salgaocar and corporate lawyer Harish Salve.

During its election campaign in 2014, the Bharatiya Janata Party (BJP) had promised to bring back black money stashed away by Indians abroad. But there is no similar emphasis on unearthing it.

Read : Panama Papers: What and Who?

BJP leaders and their close associates knew about demonetisation beforehand

All ‘BJP friends’ were allegedly alerted in time to dispose off their old notes to avoid ‘substantial losses’ following Modi’s announcement on 8 November.

A BJP MLA from Rajasthan, Bhawani Singh has publicly admitted that ‘Adani and Ambani’ were informed in advance about the demonetisation plan.

Watch the video here:

There are also reports that one BJP MP, who also owns a company that manages cash movement for ATMs and banks, paid his employees six months advance salary hours before the announcement on demonetisation.

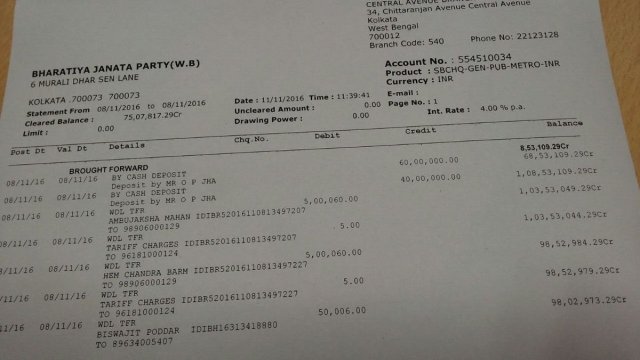

Rs 3 crore deposited’ in Bengal BJP account before demonetisation

BJP unit of West Bengal knew about the demonetisation beforehand and Rs 1 crore (in denomination of Rs 1,000 and Rs 500) was deposited at the Central Avenue branch of Indian Bank here on November 8. The money (in transactions of Rs 60 lakh and Rs 40 lakh) was deposited in a savings account no 554510034, which is in the name of the West Bengal unit of the BJP. Apart from that, Rs 75 lakh was deposited in a current account (63652513881) belonging to the West Bengal BJP unit in the same bank on November 1, Rs 1.25 crore was deposited in the same account on November 5. A total of Rs 3 crore had been deposited bank accounts of the BJP in six days preceding November 8.

Read: Rs 3 crore cash seized from BJP leader’s car in Ghaziabad

The real reason for demonetisation

Demonetisation of Rs 500 and Rs 1000 would not even scratch the tip of the iceberg. Non of the political parties intend to eradicate black money. So what could be the real reason behind demonetisation?

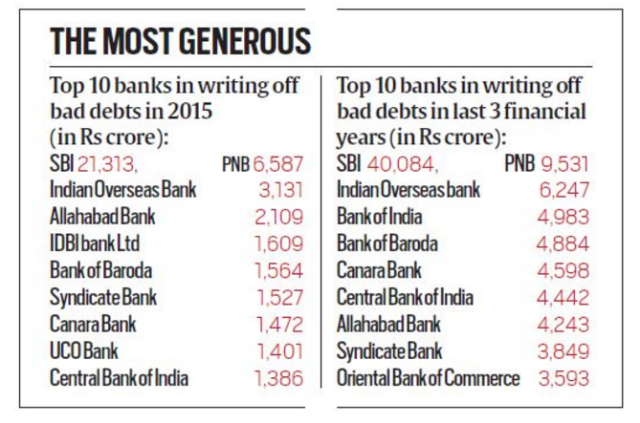

Banks wrote off a total of Rs 1.14 lakh crore of bad debts

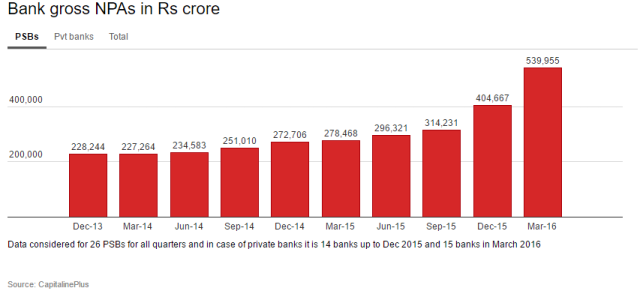

In part 1, I wrote that twenty-nine state-owned banks wrote off a total of Rs 1.14 lakh crore of bad debts between financial years 2013 and 2015, much more than they had done in the preceding nine years.

The RBI disclosed that while bad debts stood at Rs 15,551 crore for the financial year ending March 2012, they had shot up by over three times to Rs 52,542 crore by the end of March 2015.

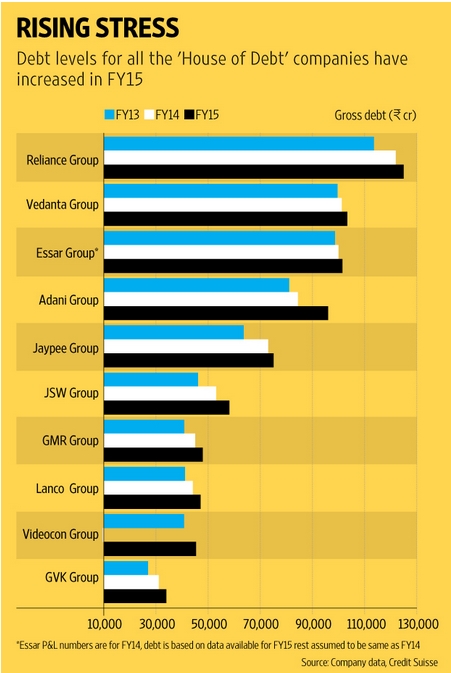

Indian banks now have close to Rs 6,00,000 crore bad loans. This demonetisation is not a step to curb black money but a measure to infuse money in those PSU banks so as to shore up their lending capacities.

Sahara and Birla bribery diary

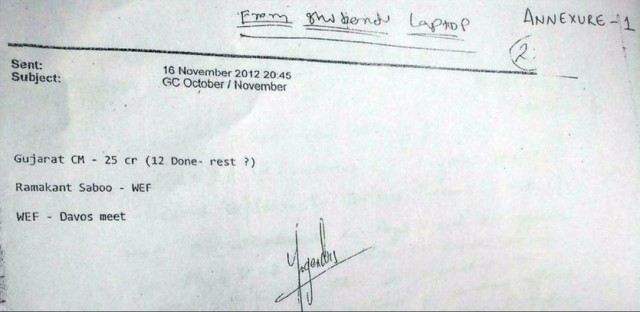

Sahara and Aditya Birla Group diaries revealed payments of crores made to ‘CM Gujarat,’ ‘Modi ji,’ ‘CM MP,’ ‘CM Chhattisgarh’ and ‘Shaina NC Ji.’

While the Birla diary mentioned a payment of Rs 25 crore to ‘Gujarat CM, documents seized from Sahara premises were even more incriminating. On page 89 of the Sahara diary, the Income Tax department’s appraisal report mentions at least eight payments made to ‘Modi ji’ in Ahmedabad via one, ‘Jaiswal ji.’

These payments, totalling Rs 40.10 crore, were made to ‘Modi ji’ by ‘Jaiswal ji’ between 30 October 2013 and 21 February 2014. By then Modi was already the BJP’s prime ministerial candidate and had launched the campaign for the Lok Sabha elections.

On the same page, there are entries of others significant payments made to ‘CM MP,’ ‘CM Chhattisgarh’ and ‘CM Delhi.’

‘CM MP’ was paid Rs 10 crore in two installments through one ‘Neeraj Vashisht’ while payment of Rs 4 crore to ‘CM Chhattisgarh’ was made by ‘Nandi ji.’

‘CM Delhi’ received Rs 1 crore by same ‘Jaiswal’ who had made payment of Rs 40.1 crore to ‘Modi ji’ and ‘CM Gujarat’ on 23 September 2013.

Sahara and Birla were raided in October 2013 and November 2014 respectively. The tax authorities were carrying out an investigation when, all of a sudden, the man at the helm of the probe, KB Chowdary, was made the head of the Chief Vigilance Commission. This, according to the Supreme Court lawyer Prashant Bhushan, was Narendra Modi government’s first attempt to scuttle the probe.

Bhushan challenged his appointment.

On 25 October this year, Bhushan wrote to all investigating agencies including the Chief Vigilance Commissioner and the two retired judges heading the Special Investigating Team on black money about bribery details stated in Sahara diaries.

The CVC allegedly alerted Union Finance Minister, Arun Jaitley about the complaint filed by Bhushan. Jaitley, in turn, warned Modi about Sahara kickback details getting wide publicity.

Bhushan said, “Clearly, my complaint to CVC and SIT caused trepidation among the establishment. They were really worried not only about this information being in possession of others but also that complaints had now been filed to ensure no hush up was done in the probe as revelations were just too serious.”

Government insiders said that whilst the Modi government had planned to launch the demonetisation sometime early next year, his decision to announce the measure so soon left many senior leaders in the government surprised.

On 8 November, Bhushan wrote to the Settlement Commission reminding them about the seriousness of the revelation in the Sahara diaries. He requested the commission not to show any immunity in the matter.

The letter turned out to be the real ‘catalyst’ and reportedly spurred Modi to immediately do something ‘big’ to divert attention.

Bhushan said, “Since this government is very good at diverting attention, it took refuge in demonetisation on this occasion because it allowed Modi to take a moral high ground on the issue of black money. He felt that after his announcement on demonetisation, it will be difficult for people to question him on the Sahara allegations.”

Modi allegedly decided to go ahead with the demonetisation plan the same day Bhushan wrote to the Settlement Commission even though banks had ‘extremely insufficient’ cash and there was no adequate plan to calibrate the ATMs across the country. Hence the continuing chaos at banks across India.

This explains why BJP’s West Bengal unit was allegedly in a ‘hurry’ to deposit Rs 1 crore into its Central Avenue branch the same day before the announcement was publicly made.

Within a span of one week, the Modi government has had to change its directives several times. They first capped the exchange limit for old notes to Rs 4,000 but was soon forced to increase it to Rs 4,500. However, just couple of days later, it reversed its own decision by reducing the limit from Rs 4,500 to Rs 2,000.

It was only after Modi had made the announcement that his government came up with the idea to apply indelible ink on those who had exchanged their old notes once.

The government finds itself in an utter mess largely due to no planning into a decision of such magnitude. Had they stuck to their original plan of launching the measure next year, most of the present mess may have been avoided. But, it seems, the government was indeed in a hurry to go ahead with this monumental move allegedly to divert people’s attention from incredibly serious charges of corruption.

Read: Birla and Sahara bribery diaries and demonetisation: Demonetisation ka Sahara

Election in UP, Punjab, Uttarakhand and Goa

Prime Minister Narendra Modi’s demonetisation of Rs 500 and Rs 1000 notes is being directly linked to the Uttar Pradesh polls.

The BJP, which had swept the Lok Sabha elections more than two years ago, winning 70 of the 80 seats in Uttar Pradesh, is seeking to make a comeback by wresting power after 15 years from the ruling SP. The BSP is expected to give a stiff challenge to both of them.

In Punjab, after two successive terms, the ruling SAD-BJP combine is facing a tough battle from Congress on the one hand and a fledgeling AAP on the other.

Uttarakhand, where the ruling Congress staged a sensational comeback this year following a legal battle, is fighting anti-incumbency and facing challenge from the BJP.

Goa, where the ruling BJP is seeking a fresh term, is pitted against Congress and AAP.

It is no secret that elections are funded by black money. The campaign had already begun, all the parties were piling their stocks.

By banning Rs 500 and Rs 1000, BJP demonetised the other political parties and escaped the same by alerting their leaders about the move beforehand. Now the other political parties have no black money to spend for the upcoming elections.

This scenario is inherently more interesting because the black money can’t be shifted abroad, because it’s needed at home, and it also can’t be converted to immovable assets because the money needs to retain a certain amount of liquidity to be during the election.

Eradicating black money: So easy to start, yet so tough!

Black money is the life-blood of all the political parties taking part in electoral process. Their sincerity to curb black money is questionable. This demonetisation is more a political move by the BJP government to show that it can take bold decisions and is serious about black money.

A study by the National Institute of Pubic Finance and Policy, which has not yet been published but has been submitted to the finance minister, shows about 80 per cent of major political party funding are in cash and broken into lots of Rs 20,000 or less received from unnamed individuals.

We demand Prime Minister Narendra Modi or finance minister Arun Jaitley give a commitment that the BJP will not take cash from corporate in the upcoming elections.

Ensure none of the political parties taking part in electoral process are allowed to take donation in cash.

There should not be any donation from undisclosed source.

Breaking the politics -business nexus is the first step to eradicate black money.

During its election campaign in 2014, the Bharatiya Janata Party (BJP) had promised to bring back black money stashed away by Indians abroad.

We heard about wikileaks list of Indian black money holders in Swiss bank. We heard about Panama Papers. Why is our government sitting like a lame duck?

We demand our government to investigate and take action.

We demand Reserve Bank of India not to allow compounding (recognising that an individual has erred bona fide and regularising the investment in the offshore entity post facto by imposing a penalty) or insist that individuals wind up these investments made prior to August 2013.

We demand The Income Tax department to probe if there has been ‘round tripping’ of funds i.e. routing of funds invested in offshore entities back to India, and where required, refer the cases to the Enforcement Directorate. Investigate if the offshore entities have declared all their incomes and assets to the Income Tax department.

That would be the beginning of a true surgical strike against black money.

Shishir K Bajoria belongs to one of the oldest business families in Kolkata trading in jute and tea. He is the promoter of SK Bajoria Group, which has steel refractory units in six countries with an annual turnover of $200 million.

Shishir K Bajoria belongs to one of the oldest business families in Kolkata trading in jute and tea. He is the promoter of SK Bajoria Group, which has steel refractory units in six countries with an annual turnover of $200 million.